Difference between a Mortgage Report and a Land Title/Boundary Survey

We are asked all the time what is the difference between these two types of surveys.

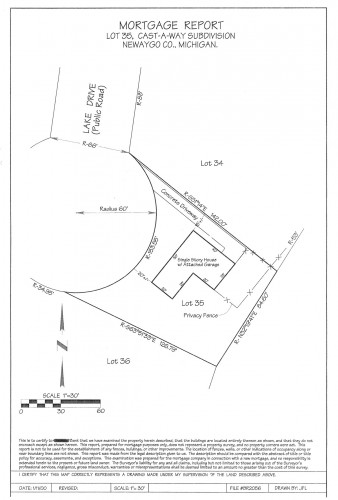

Mortgage reports are usually requested by lending institutions to assure the bank that the house and improvements are actually on the property being mortgaged. Even though the homeowner pays for the cost of the mortgage report, seldom if ever is the drawing provided to the buyer at closing. A typical mortgage survey does not have stakes left in the ground so that the buyer knows what he has purchased. Also the drawing usually contains numerous disclaimer statements that we like to call weasel words. “This survey isn’t a real survey and shouldn’t be used to determine the location of property lines, etc. etc.” I like to call these mortgage surveys fly byes, as I hardly believe that the surveyor ever leaves his vehicle and only makes estimations where the building might be relative to some apparent line of occupation. I once had a loan officer at a local lending institution show me 5 different mortgage reports done by the same survey firm on the same mortgaged property over the course of 20 years. He brought to my attention that it was apparent from his review of the drawings that the same house was moving and it had moved about 20 feet. Our professional practice does not include providing Mortgage Reports. They are an injustice to the consumer and the industry.

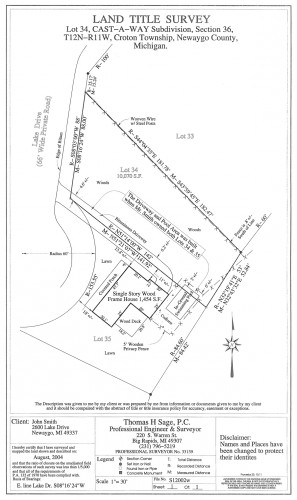

A Land Title/Boundary Survey is a real survey. We start the process by obtaining a copy of the Title insurance commitment policy and research the deeds and easements listed. We then find, set or establish all property corners and leave stakes in the ground for the buyer to see and know what he is actually buying. We then will map all buildings, fences, easements, etc. that affect the property and create a drawing. This is a real survey that not only satisfies the lender but most importantly provides the buyer with a tangible product. After all, the buyer, not the bank is paying for the survey. Prices vary depending on the description and location of the property. Our typical fee is usually about twice the amount that is typically charged for a mortgage report.

The following are samples of these types of surveys. Click an image to view it larger.

It appears that the Mortgage Report Surveyor assumed that the wood privacy fence was built on the lot line and used that fence line for the basis of his survey. When the buyer of the next door lot requested that Lot #34 be staked prior to his purchase it was discovered that not only the wood privacy fence wasn’t built on the lot line but also a portion of the inground swimming pool was built over the lot line.